How We Help Financial Services Clients De‑Risk CRM Investments and Build a Platform for Growth

In many financial services organisations, CRM systems gradually become the backbone of daily operations. What starts as a tool for managing leads and client interactions often expands to support compliance workflows, advisory processes, document handling, and reporting. Over time, this expansion introduces hidden risk. Investment in CRM increases, yet confidence in data, processes, and scalability quietly erodes.

At Zolution, we work with financial services clients at this critical juncture. Our role is not to sell more automation, but to help leadership regain clarity. By establishing a clear understanding of the current operating environment, we help organisations de‑risk CRM investments and lay the groundwork for sustainable, well‑governed growth.

The Real Risk Is Not the CRM Platform

Most financial advisory and regulated services firms we engage already have a CRM system in place. The challenge is rarely the technology itself. The real risk lies in the gradual misalignment between how the business operates, how data is handled, and how the system is expected to support both.

As teams grow and regulatory demands evolve, processes tend to develop organically. Data is captured multiple times in different formats. Approvals and reviews rely on a mix of system steps and informal communication. Documents are stored across several tools depending on team preference or historical practice. Individually, these decisions feel practical. Collectively, they introduce operational fragility.

Without a clear and objective view of the current state, further CRM enhancements can unintentionally hard‑code inefficiencies, increase compliance exposure, or create long‑term dependencies that are difficult and costly to unwind.

A Consulting‑Led Way to De‑Risk CRM Decisions

Zolution supports financial services organisations by stepping in before major CRM changes are made. Our consulting engagements are designed to give leadership the insight needed to make confident, well‑sequenced decisions.

Rather than focusing on features or tools, we provide clarity through a set of structured consulting outputs:

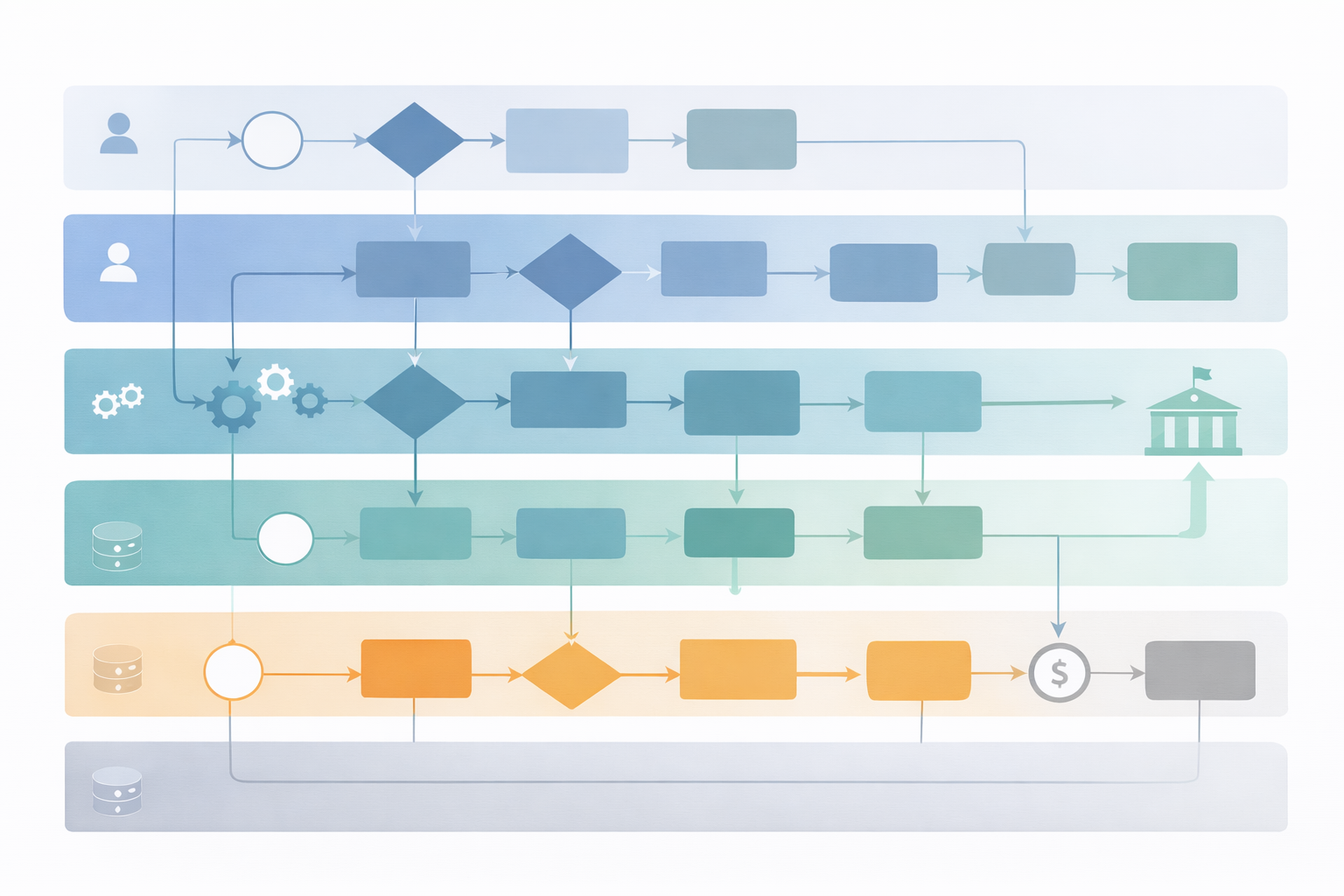

- End‑to‑end process mapping diagrams that reveal how work, data, and decisions actually flow across teams

- Consolidated interview findings that surface recurring pain points, constraints, and disconnects between intended and actual practices

- A CRM auditing report assessing system configuration, data structure, automation logic, and governance against real‑world usage

- Identification of material operational, data, and compliance risks embedded in the current setup

- Strategic recommendations and a future roadmap to guide prioritisation, sequencing, and solution design

Together, these artefacts replace assumptions with evidence and create a shared understanding across business and technology stakeholders.

Value That Extends Beyond the System

The primary value of this work is not a list of technical fixes. It is decision clarity.

By understanding where issues originate—whether from process design, data ownership, governance gaps, or adoption challenges—organisations can address root causes rather than symptoms. This significantly reduces the risk of investing in solutions that look correct on paper but fail in practice.

Clients use this clarity to align teams around a common operating model, distinguish short‑term stabilisation from longer‑term transformation, and ensure that CRM investments directly support regulatory, operational, and strategic objectives.

Rather than treating CRM as a standalone platform, we help position it correctly as part of a broader operating and data model.

Creating a Foundation for Sustainable Growth

In regulated environments, growth is constrained not by ambition, but by confidence—confidence in data integrity, process ownership, and auditability. Automation alone cannot provide this. It must be built on a clear understanding of the current state and a deliberate path forward.

By starting with a structured assessment of operations and CRM usage, financial services organisations can de‑risk future investments and build a platform that scales with the business. This ensures that subsequent implementation or automation efforts are purposeful, aligned, and resilient as complexity increases.

This consulting‑led approach is how Zolution helps financial services clients move forward with confidence—turning CRM from a source of uncertainty into a strategic asset.